VA Home Loans: Easy Tips to Qualify and Make An Application For Professional Perks

VA Home Loans: Easy Tips to Qualify and Make An Application For Professional Perks

Blog Article

Maximizing the Advantages of Home Loans: A Step-by-Step Strategy to Protecting Your Perfect Property

Navigating the complex landscape of mortgage needs a methodical method to make certain that you secure the residential property that lines up with your economic objectives. By beginning with a detailed analysis of your financial placement, you can determine the most appropriate finance choices readily available to you. Understanding the subtleties of various financing types and preparing a meticulous application can dramatically affect your success. The complexities do not finish there; the closing process demands equal attention to information. To truly maximize the advantages of home mortgage, one must consider what actions follow this fundamental job.

Recognizing Home Mortgage Fundamentals

Understanding the fundamentals of mortgage is important for any individual taking into consideration buying a property. A home financing, typically referred to as a mortgage, is an economic item that permits people to obtain money to get realty. The customer accepts pay back the financing over a defined term, typically ranging from 15 to three decades, with interest.

Secret components of mortgage consist of the primary quantity, rate of interest, and repayment schedules. The principal is the quantity borrowed, while the interest is the expense of loaning that amount, revealed as a portion. Interest prices can be taken care of, remaining constant throughout the finance term, or variable, rising and fall based upon market conditions.

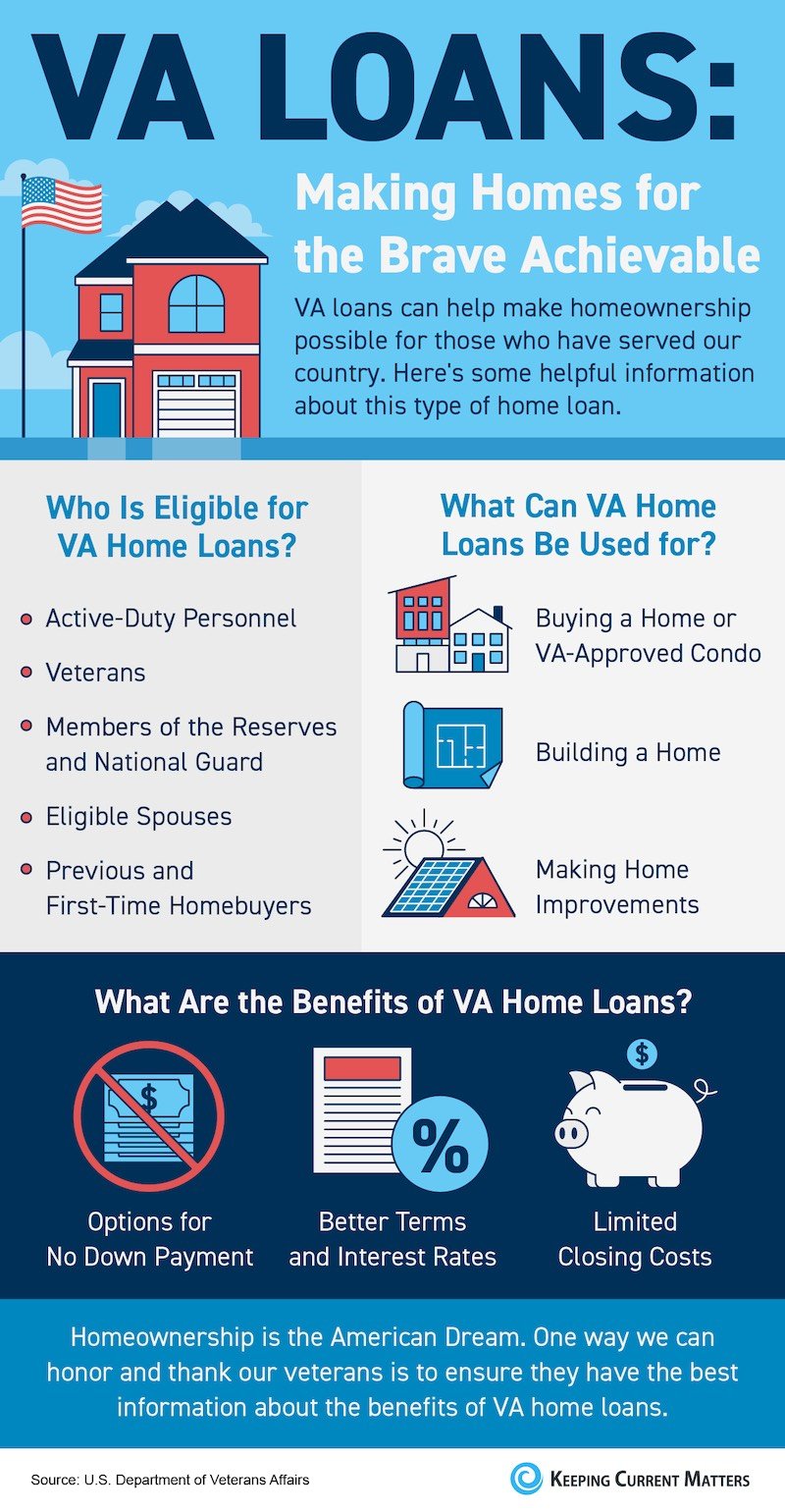

Furthermore, consumers must be conscious of different sorts of mortgage, such as conventional financings, FHA lendings, and VA loans, each with unique qualification standards and advantages. Understanding terms such as down payment, loan-to-value ratio, and exclusive mortgage insurance (PMI) is additionally critical for making educated decisions. By realizing these essentials, prospective home owners can browse the complexities of the mortgage market and recognize alternatives that straighten with their financial goals and residential property desires.

Evaluating Your Financial Situation

Examining your monetary scenario is a critical step prior to getting started on the home-buying trip. Next, checklist all monthly costs, making sure to account for dealt with expenses like lease, utilities, and variable expenditures such as groceries and entertainment.

After establishing your earnings and expenses, identify your debt-to-income (DTI) proportion, which is essential for lending institutions. This proportion is determined by separating your overall monthly financial debt repayments by your gross regular monthly revenue. A DTI proportion below 36% is generally considered positive, indicating that you are not over-leveraged.

Additionally, analyze your credit report, as it plays a pivotal role in securing desirable lending terms. A higher credit rating can lead to lower interest prices, inevitably conserving you money over the life of the financing.

Checking Out Lending Alternatives

With a clear image of your economic scenario established, the next action involves checking out the numerous financing alternatives available to potential home owners. Understanding the various sorts of home mortgage is vital in picking the ideal one for your requirements.

Traditional fundings are standard financing techniques that generally call for a higher credit report and down settlement yet offer affordable rate of interest. On the other hand, government-backed car loans, such as FHA, VA, and USDA lendings, accommodate certain teams and usually need reduced deposits and credit history, making them accessible for novice purchasers or those with limited financial sources.

One more alternative is adjustable-rate mortgages (ARMs), which include lower preliminary prices that adjust after a specific duration, potentially bring about significant financial savings. Fixed-rate home mortgages, on the various other hand, give stability with a constant rate of interest throughout the lending term, securing you versus market fluctuations.

Furthermore, take into consideration the financing term, which frequently varies from 15 to thirty years. Shorter terms may have greater regular monthly repayments but can conserve you rate of interest over time. By thoroughly evaluating these choices, you can make an educated decision that aligns with your economic goals and homeownership ambitions.

Planning For the Application

Successfully planning for the application procedure is vital for safeguarding a home loan. This phase prepares for obtaining positive finance terms and makes certain a smoother approval experience. Begin by evaluating your economic scenario, which consists of assessing your credit rating, earnings, and existing debt. A solid debt rating is important, as it influences the finance amount and rate of interest offered to you.

Organizing these papers in advancement can considerably speed up the application process. This not just offers a clear understanding of your borrowing capacity however also enhances your setting when making an offer on a residential property.

Furthermore, determine your budget plan by factoring in not just the funding amount yet also real estate tax, insurance coverage, and upkeep prices. Acquaint on your own with different financing types and their corresponding terms, as this knowledge will empower you to make informed choices throughout the application process. By taking these positive actions, you will certainly enhance your readiness and increase your opportunities of protecting the mortgage that best fits your requirements.

Closing the Deal

During the closing meeting, you will certainly assess and sign numerous documents, such as the loan estimate, shutting disclosure, and mortgage agreement. It is essential to thoroughly comprehend these records, as they describe the finance terms, payment timetable, and closing costs. Take the time to ask your loan provider or property agent any inquiries you may have to stay clear of misunderstandings.

As soon as all records are authorized and funds are moved, you will certainly receive the tricks to your brand-new home. Bear in mind, closing expenses can differ, so be gotten ready for expenses that might include evaluation charges, title insurance policy, and lawyer fees - VA Home Loans. By staying arranged and informed throughout this process, you can guarantee a smooth shift into homeownership, taking full advantage of the read review benefits of your mortgage

Conclusion

Finally, making best use of the advantages of mortgage demands a systematic strategy, incorporating a comprehensive evaluation of economic conditions, expedition of diverse car loan choices, and thorough preparation for the application procedure. By adhering to these actions, possible house owners can improve their possibilities of securing beneficial funding and achieving their residential or commercial property possession goals. Inevitably, mindful navigating of the closing process better strengthens an effective transition right into homeownership, making certain long-term economic stability and complete satisfaction.

Navigating the complicated landscape of home lendings calls for a methodical approach to guarantee that you safeguard the residential or commercial property that straightens with your economic objectives.Recognizing the fundamentals of home car loans is important for any individual taking into consideration buying a residential property - VA Home Loans. A home funding, commonly referred to as a home loan, is an economic product that permits people to obtain money to get real estate.Additionally, borrowers must be aware of different kinds of home financings, such as standard financings, FHA finances, and VA car loans, each with distinct qualification criteria and advantages.In conclusion, making best use of the advantages of home finances requires a systematic method, incorporating a complete assessment of financial conditions, exploration of varied loan options, and careful preparation for the application procedure

Report this page